The Total Guide to Submitting an Online Tax Return in Australia in 2024

The Total Guide to Submitting an Online Tax Return in Australia in 2024

Blog Article

Navigate Your Online Income Tax Return in Australia: Crucial Resources and Tips

Navigating the on-line tax obligation return procedure in Australia requires a clear understanding of your commitments and the resources available to streamline the experience. Crucial papers, such as your Tax File Number and income declarations, need to be meticulously prepared. Picking a proper online platform can dramatically affect the performance of your filing process.

Comprehending Tax Responsibilities

People have to report their income accurately, which includes wages, rental income, and investment profits, and pay tax obligations appropriately. Locals have to understand the difference in between non-taxable and taxable income to ensure conformity and optimize tax obligation results.

For businesses, tax obligation obligations include multiple facets, consisting of the Product and Solutions Tax (GST), company tax obligation, and payroll tax. It is important for companies to sign up for an Australian Organization Number (ABN) and, if applicable, GST registration. These duties require precise record-keeping and prompt entries of tax obligation returns.

Furthermore, taxpayers should recognize with offered reductions and offsets that can ease their tax worry. Inquiring from tax professionals can supply important understandings right into optimizing tax placements while making sure conformity with the legislation. Overall, a detailed understanding of tax responsibilities is important for effective financial preparation and to avoid fines connected with non-compliance in Australia.

Necessary Files to Prepare

Furthermore, compile any kind of pertinent financial institution declarations that mirror passion income, in addition to returns statements if you hold shares. If you have other incomes, such as rental residential or commercial properties or freelance work, ensure you have records of these profits and any kind of linked expenditures.

Consider any private health and wellness insurance coverage declarations, as these can influence your tax obligations. By collecting these vital records in development, you will simplify your on the internet tax obligation return procedure, minimize mistakes, and maximize prospective refunds.

Choosing the Right Online System

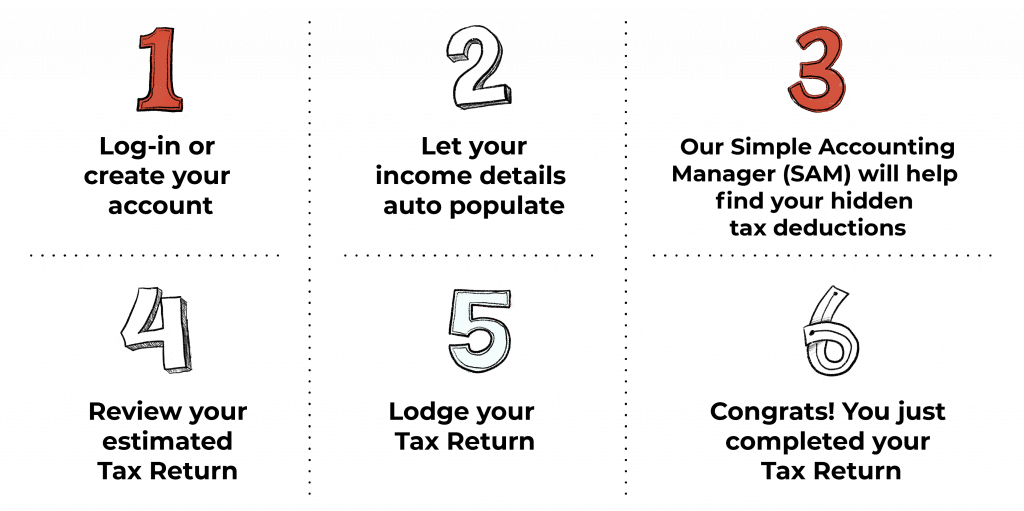

As you prepare to submit your on the internet tax obligation return in Australia, selecting the appropriate system is essential to make sure precision and convenience of usage. A straightforward, user-friendly layout can significantly enhance your experience, making it easier to browse intricate tax obligation kinds.

Next, evaluate the system's compatibility with your economic scenario. Some solutions provide especially to individuals with easy tax returns, while others supply thorough assistance for a lot more intricate circumstances, such as self-employment or financial investment earnings. Moreover, look for platforms that provide real-time error checking and assistance, assisting to minimize mistakes and making certain conformity with Australian tax regulations.

Another essential facet to consider is the level of consumer assistance readily available. Reliable platforms must supply access to aid using conversation, e-mail, or phone, especially during peak declaring durations. Additionally, study user reviews and rankings to assess the general complete satisfaction and reliability of the system.

Tips for a Smooth Filing Process

If you comply with a few vital ideas to make sure efficiency and accuracy,Submitting your on-line tax return can be a simple my blog process - online tax return in Australia. Collect all essential documents before starting. This includes your earnings declarations, invoices for reductions, and any kind of other relevant documentation. Having whatever at hand decreases interruptions and mistakes.

Following, make use of the pre-filling function provided by numerous on the internet systems. This can save time and minimize the possibility of mistakes by instantly inhabiting your return with info from previous years and information given by your company and banks.

Additionally, verify all access for accuracy. online tax return in Australia. Blunders can lead to postponed refunds or issues with the Australian Taxes Workplace (ATO) See to it that your personal details, income figures, and reductions are correct

Filing early not only look here reduces stress and anxiety but also permits for better preparation if you owe taxes. By complying with these pointers, you can navigate the on the internet tax return procedure smoothly and confidently.

Resources for Support and Assistance

Browsing the intricacies of online income tax return can sometimes be difficult, however a variety of resources for help and support are easily available to aid taxpayers. The Australian Tax Workplace (ATO) is the key resource of information, supplying extensive overviews on its website, including Frequently asked questions, instructional videos, and live conversation alternatives for real-time aid.

In Addition, the ATO's phone assistance line is available for those that prefer direct interaction. online tax return in Australia. Tax obligation specialists, such as registered tax obligation representatives, can likewise offer customized assistance and ensure compliance with present tax obligation guidelines

Verdict

To conclude, successfully navigating the online tax obligation return process in Australia requires a detailed understanding of tax obligation commitments, thorough preparation of crucial documents, and mindful option of a suitable online system. Complying with useful ideas can boost the declaring experience, while offered resources offer valuable support. By approaching the process with diligence you could try this out and interest to detail, taxpayers can make certain conformity and optimize possible advantages, inevitably adding to a much more reliable and effective tax obligation return end result.

As you prepare to file your on-line tax return in Australia, picking the ideal system is crucial to guarantee accuracy and simplicity of usage.In verdict, efficiently browsing the online tax return procedure in Australia calls for a comprehensive understanding of tax commitments, careful preparation of vital records, and careful option of a proper online system.

Report this page